Tax Threshold For 2025

Tax Threshold For 2025. The maximum contribution for 2025 is $31,560; Here’s what you need to know.

In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26). Who should use this guide?

Tax rates for the 2025 year of assessment Just One Lap, What if your pay period is not in this guide? The 2025 limit is $32,490.

Maximize Your Paycheck Understanding FICA Tax in 2025, 12.2% on taxable income over $101,198 up to $164,525. To put a finer point on this, selling 200 of the same item at a price of $5 for a total of $1,000 would be sufficient to require the seller to comply with the arkansas sales.

Federal Budget 202324 Personal tax Pitcher Partners, The changes will go into effect on march 31, and the golden visa threshold will also increase from €250,000 to €400,000 for the rest of the country. In total, that adds up to $9,227.31.

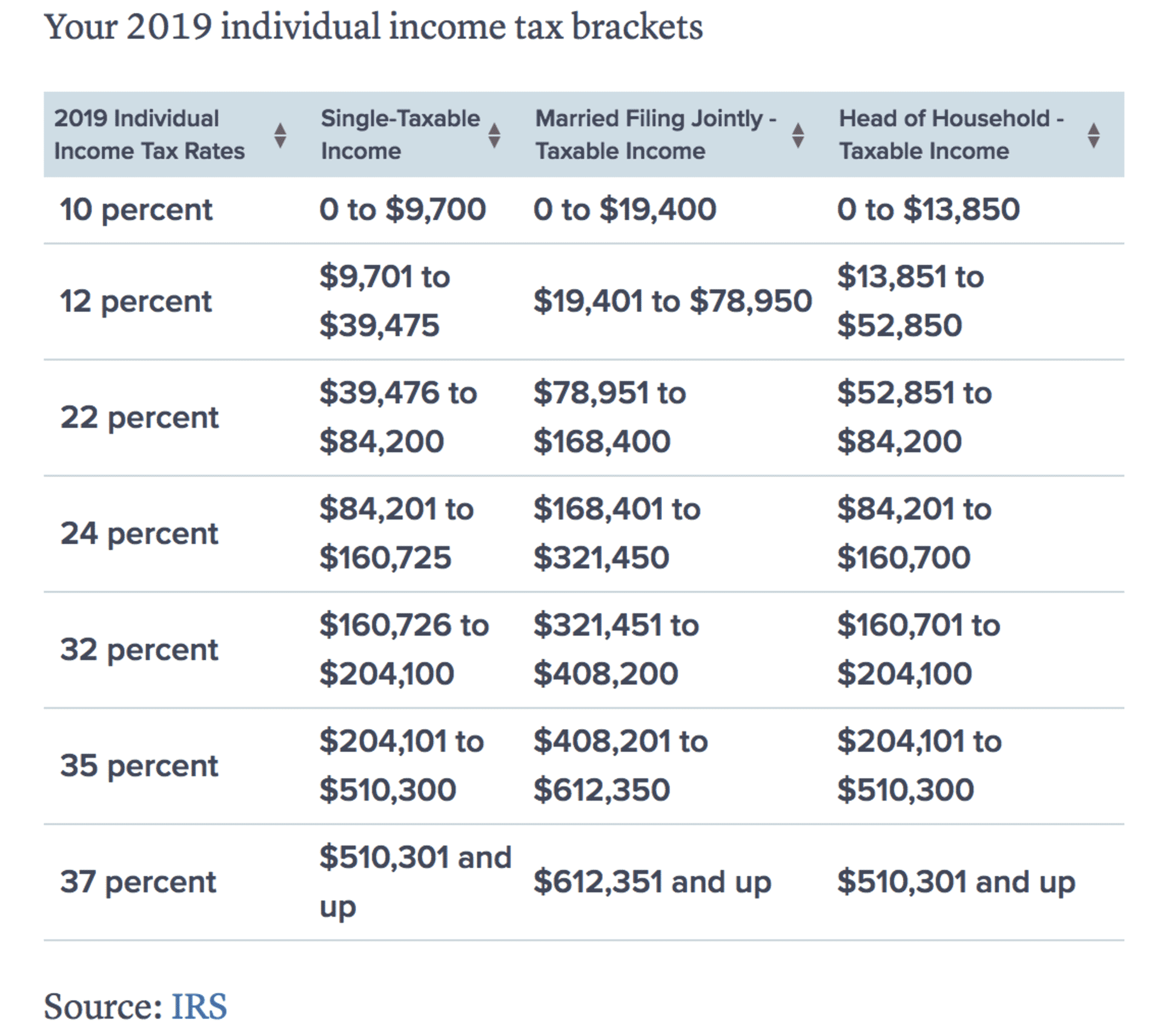

2025 Tax Brackets Calculator Nedi Lorianne, This amount is adjusted annually to account for inflation and other economic factors. See current federal tax brackets and rates based on your income and filing.

Tax Rates 2025 To 2025 2025 Printable Calendar, In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26). This amount is adjusted annually to account for inflation and other economic factors.

Tax Season 2025 Shocking Threshold You Need to Know Nummus News, The changes will go into effect on march 31, and the golden visa threshold will also increase from €250,000 to €400,000 for the rest of the country. The maximum contribution for 2025 is $31,560;

Autumn Statement 2025 HMRC tax rates and allowances for 2025/24, Calculating the federal tax bill based on the updated 2025 federal tax rates, the first $55,867 of your income is taxed at 15%, which works out to $8,380.05. Page last reviewed or updated:

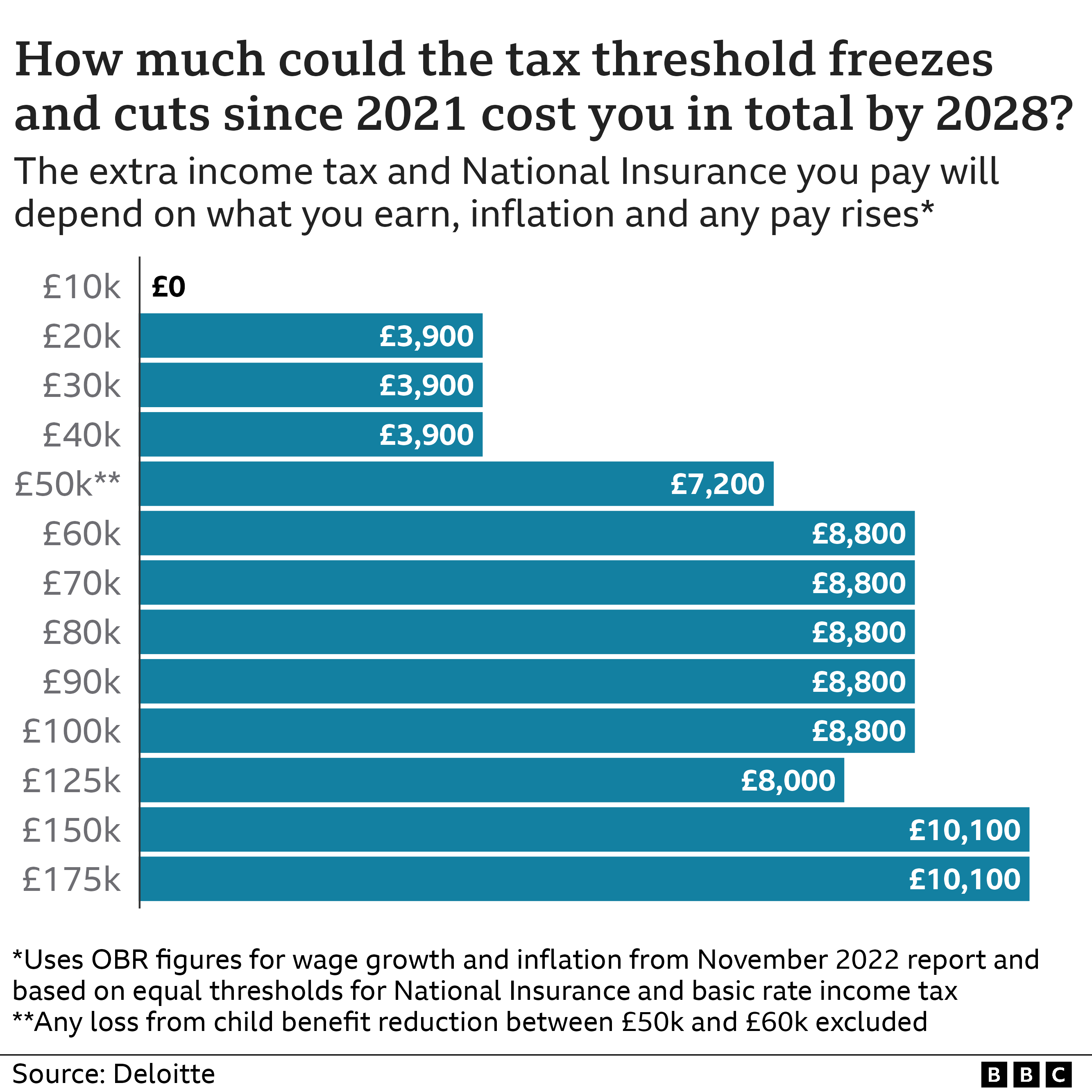

tax How will thresholds change and what will I pay? BBC News, From $14,156 to $15,705 for taxpayers with net income (line 23600). The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000.

How Will The Tax Reform Affect W2 and 1099 Tax Filings?, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Calculating the federal tax bill based on the updated 2025 federal tax rates, the first $55,867 of your income is taxed at 15%, which works out to $8,380.05.

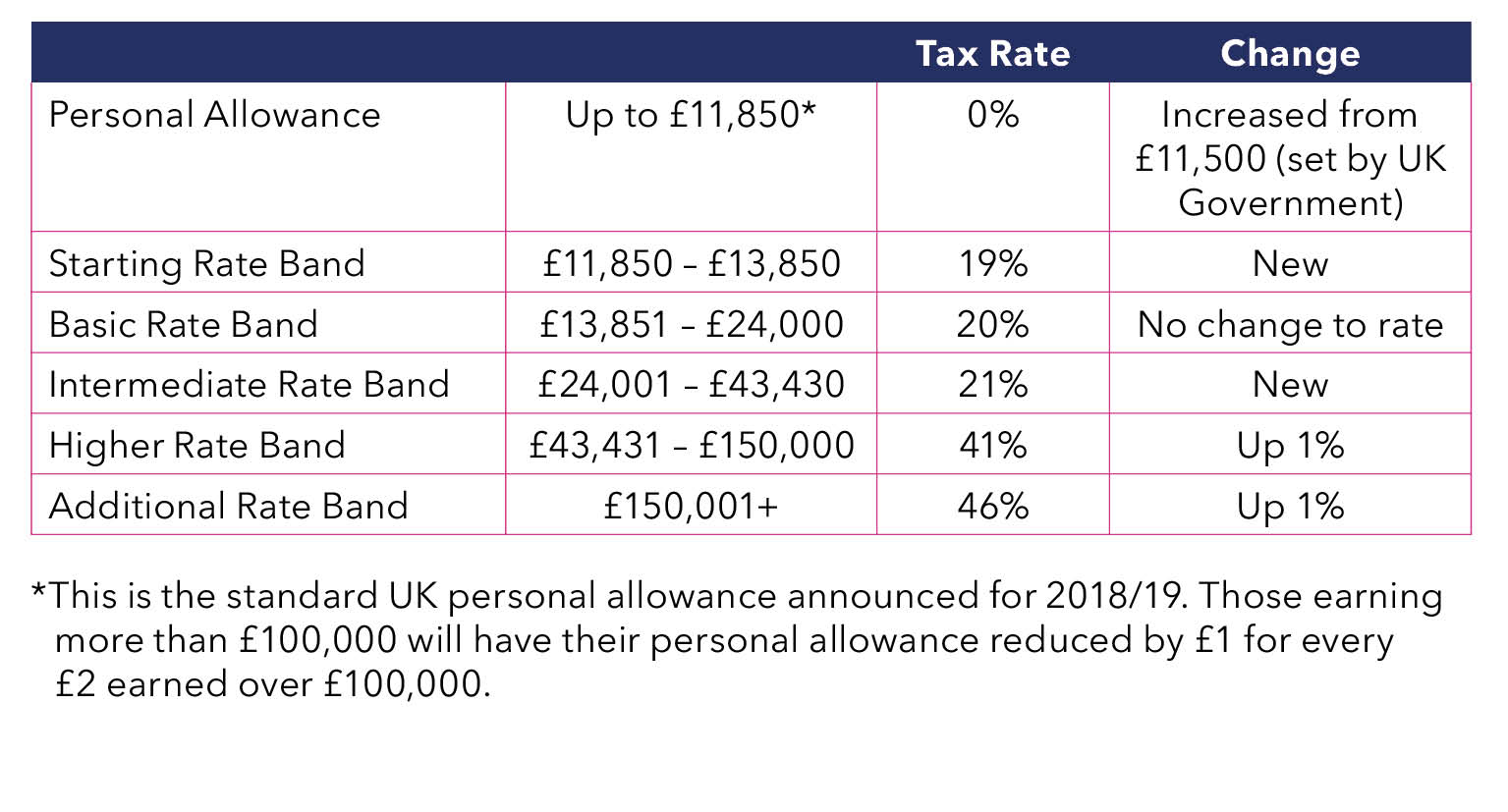

Scottish Tax Rates 2025 To 2025 PELAJARAN, The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000. In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26).

In 2025, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26).

Proudly powered by WordPress | Theme: Newsup by Themeansar.